Dear Capitolisters,

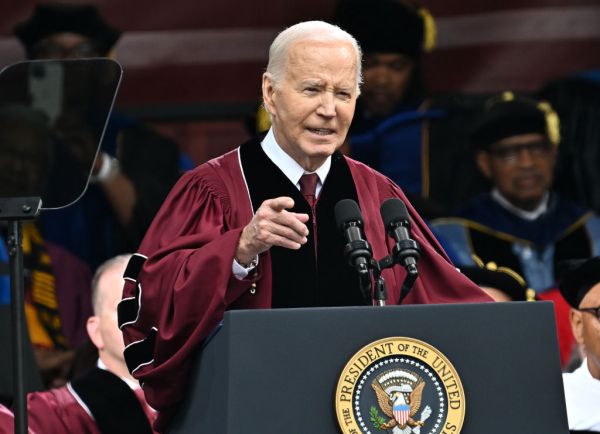

The stubbornly persistent pandemic, events in Ukraine, and simmering U.S.-China tensions have led numerous commentators—and not just the usual skeptics—to boldly proclaim that we’re entering a new era of “deglobalization.” Factories are reshoring, economies are decoupling, and everyone has given up on “free trade.” Influential investors are now openly wondering, as the New York Times reports ominously, whether we’re seeing the “End of Globalization.”

Surely, there are worrying signs for the global economy (some of which, by the way, emerged long before the pandemic). However, commentators have been wrongly predicting globalization’s imminent demise for years, and the evidence we have—so far, at least—shows less that “globalization” is dying and more that it’s constantly evolving in response to various economic and geopolitical trends, including the ones we’re seeing today. Indeed, much of the problem with the current “deglobalization” talk right now is that it seems to misunderstand (sometimes wildly) what “globalization” actually is and the rules that govern it.

There’s a lot to cover here, so this discussion will consist of two parts. Today, you’ll get Part 1; next week you’ll get—go figure—Part 2. (This approach seemed better—for you and me!—than giving you 5,000 words today.)

So let’s dig right in.

‘Globalization’ Isn’t Just Goods

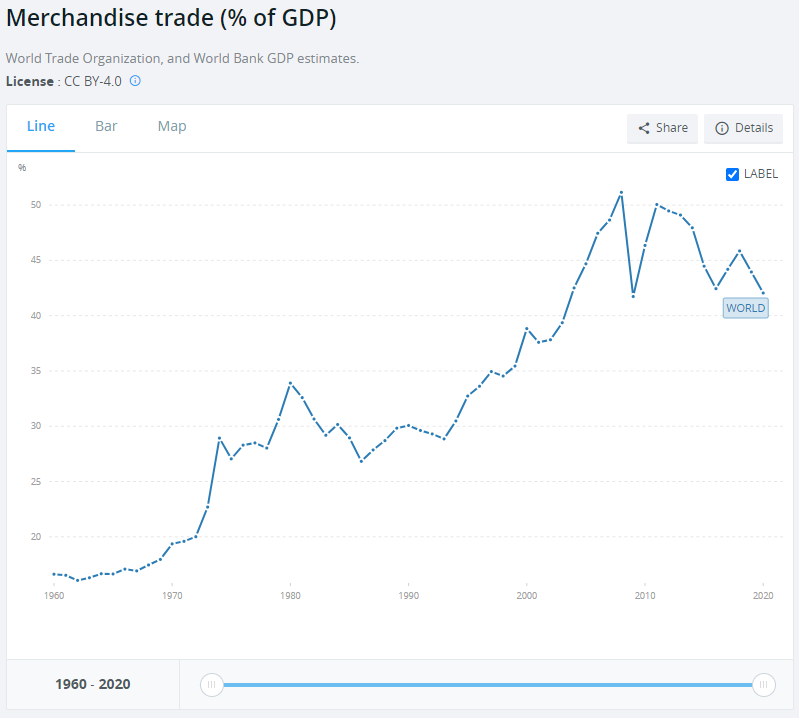

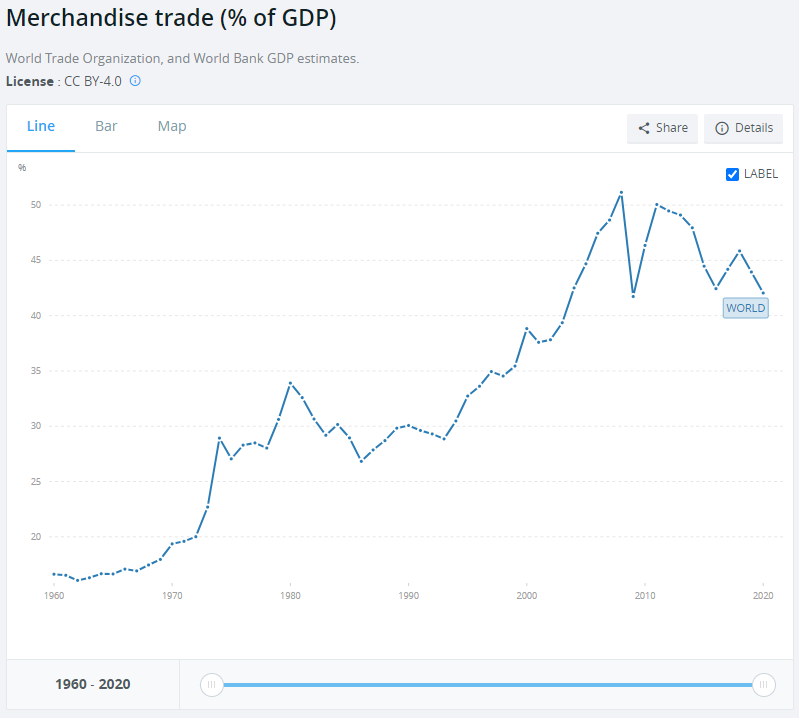

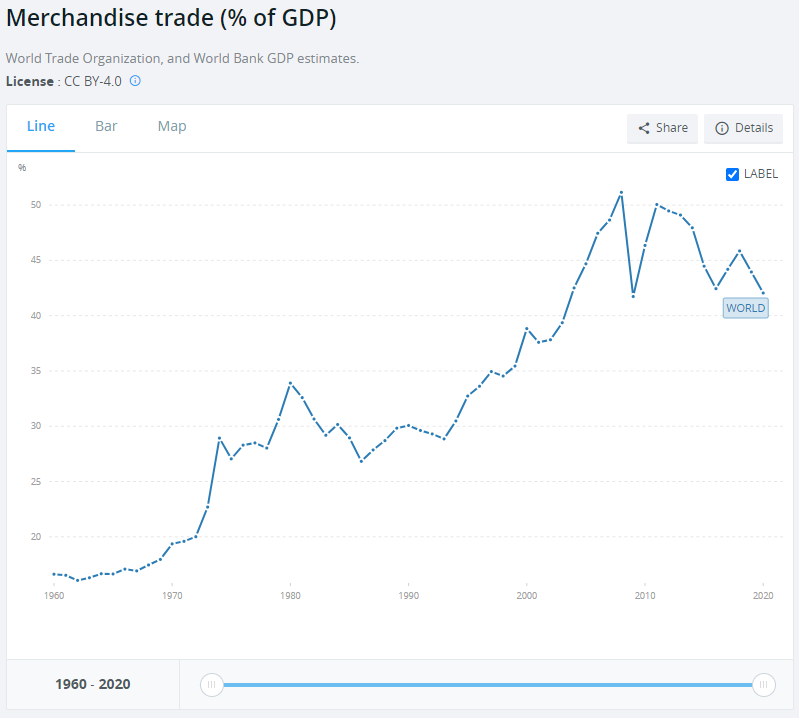

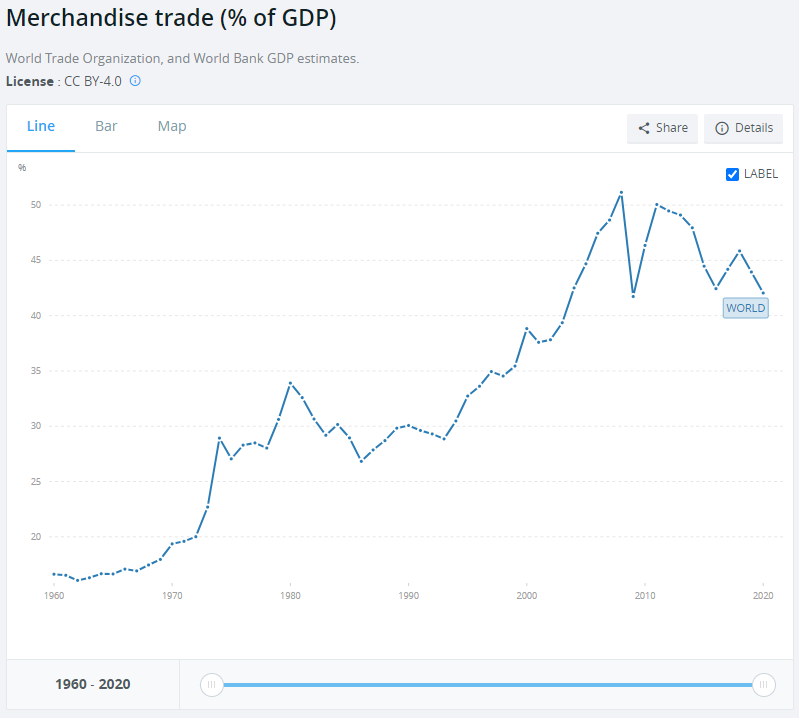

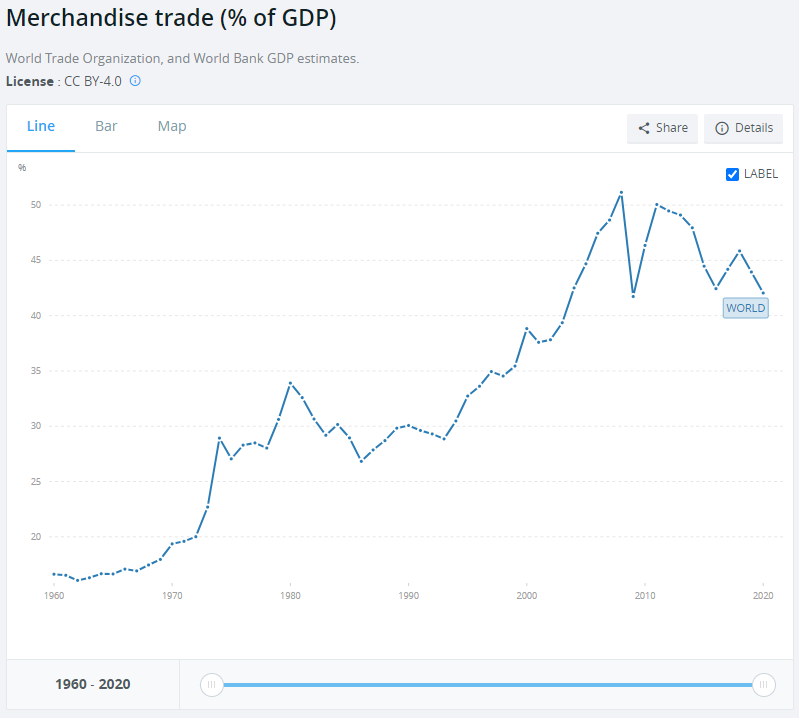

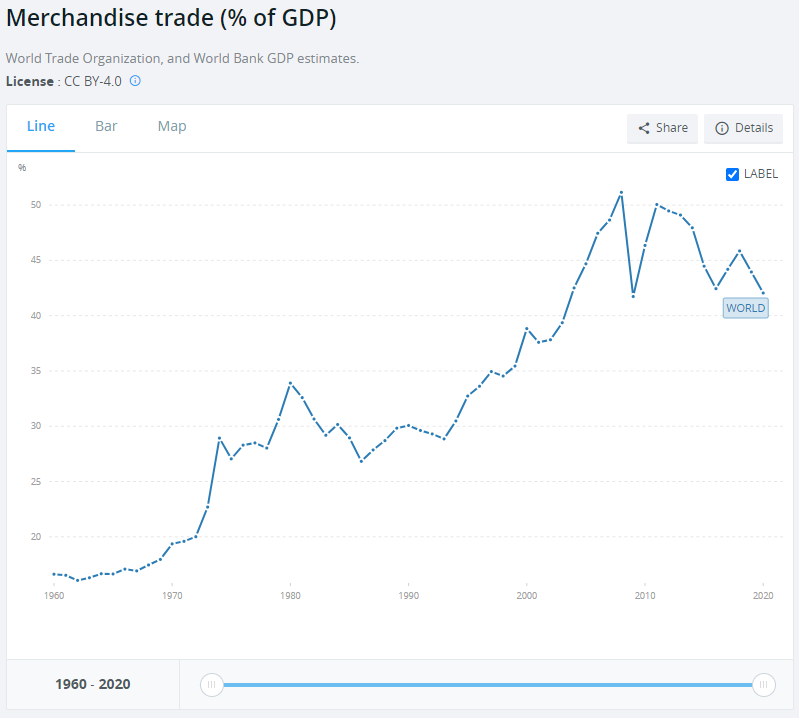

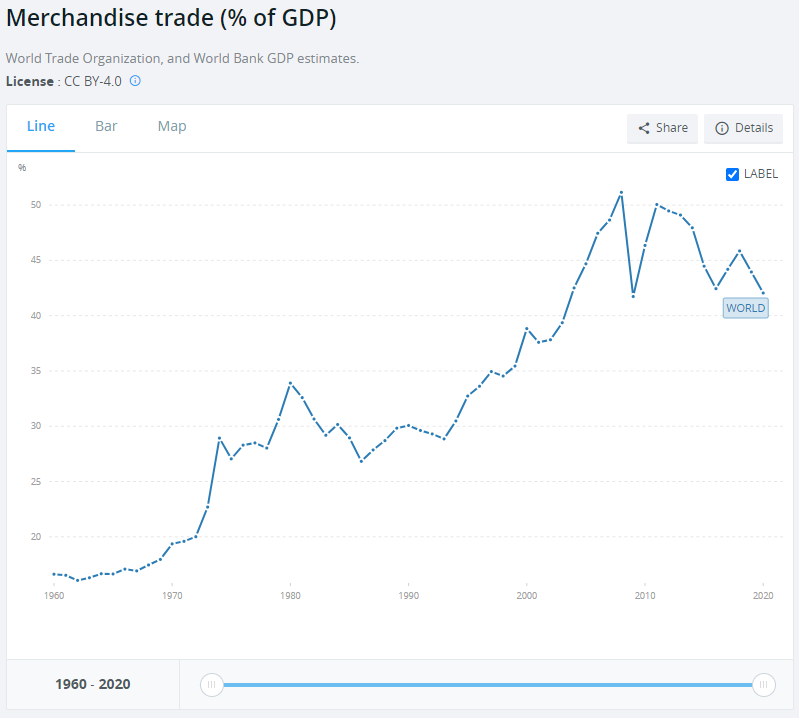

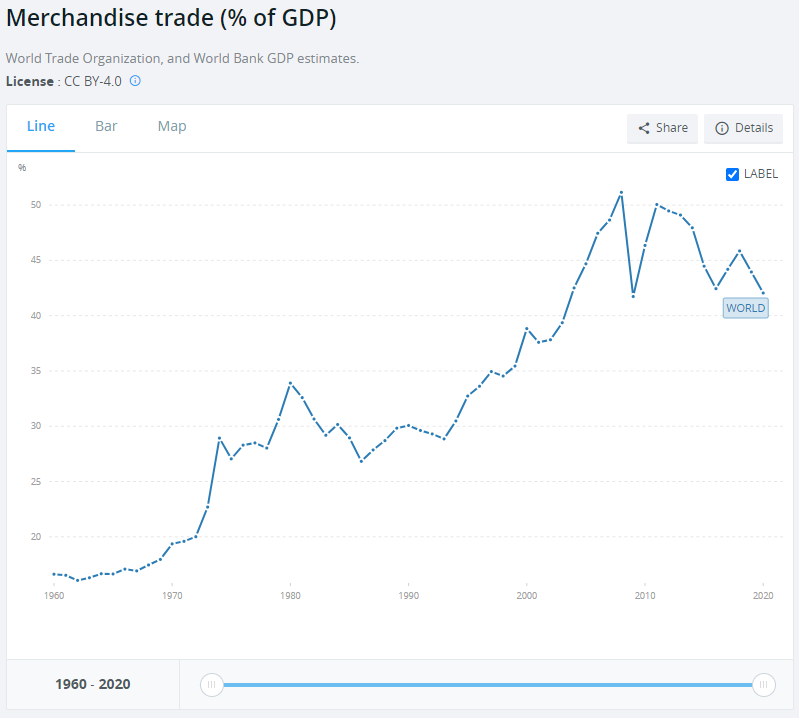

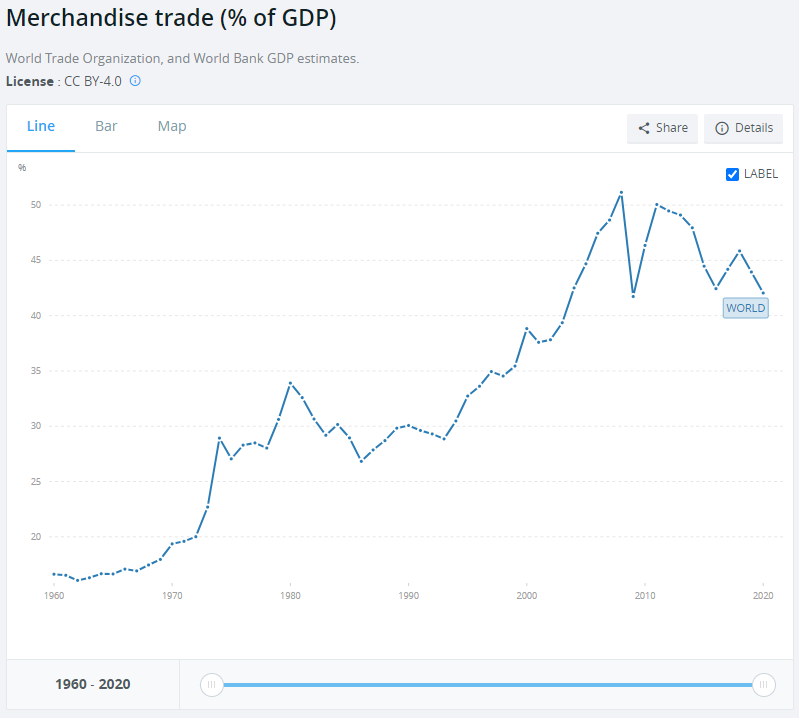

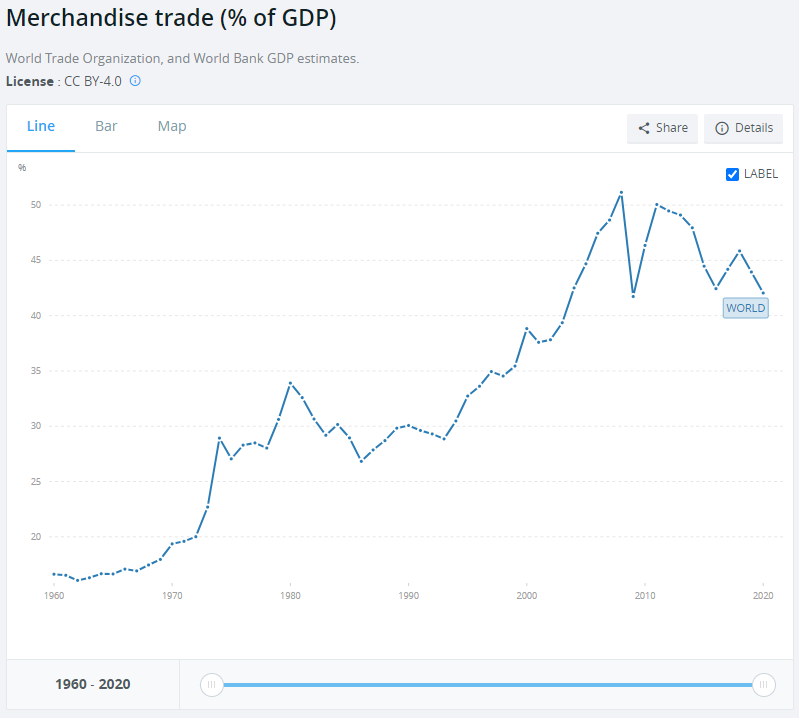

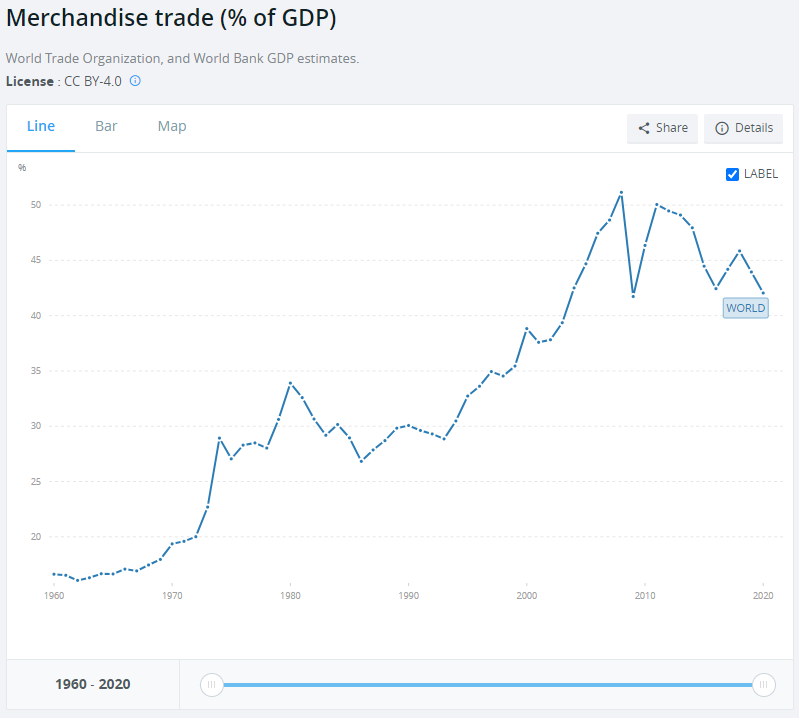

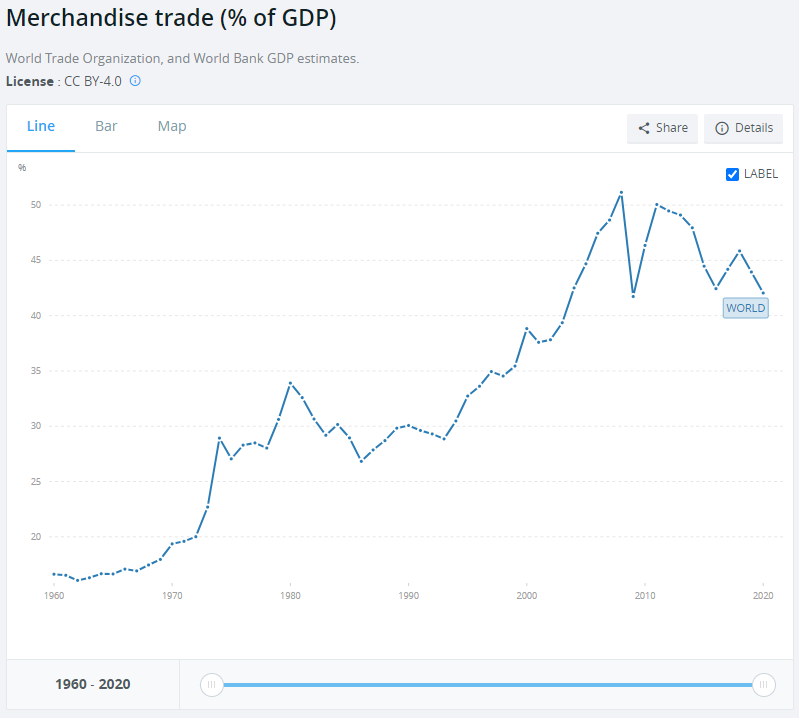

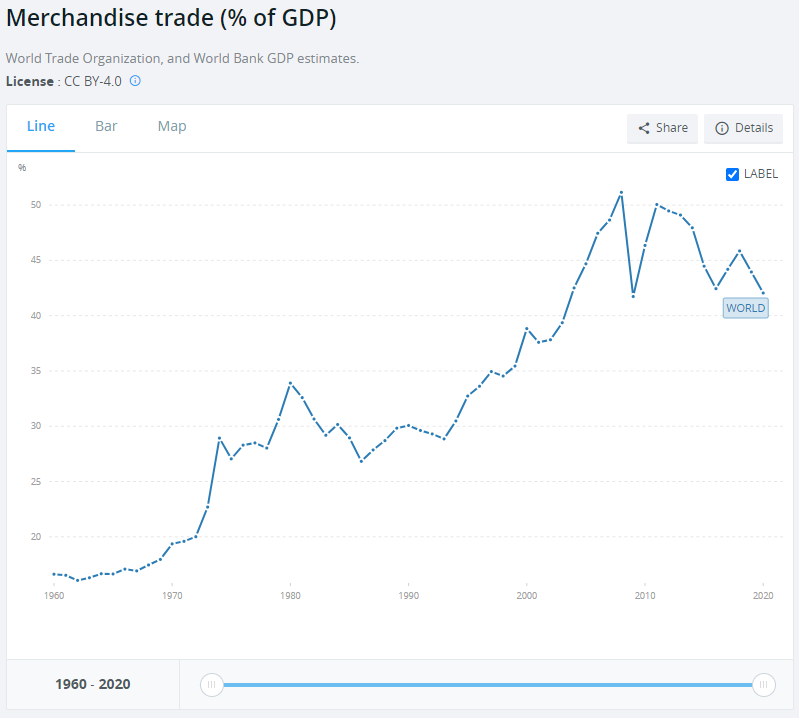

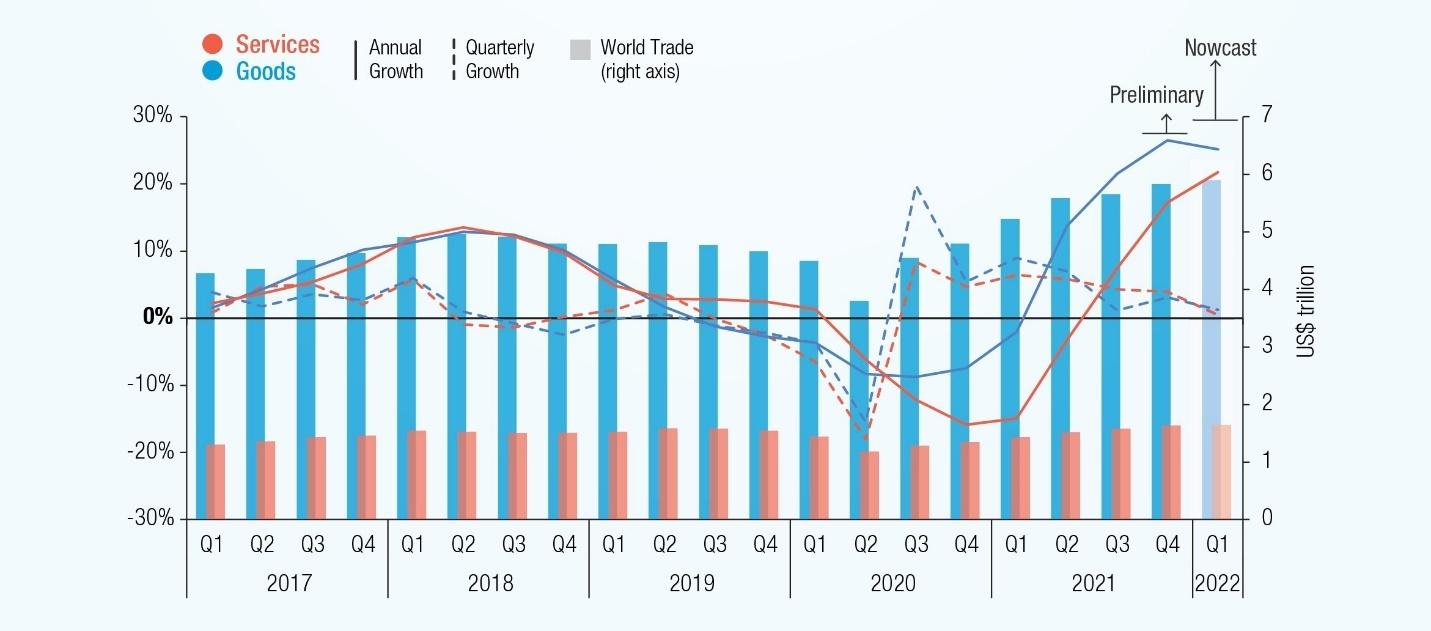

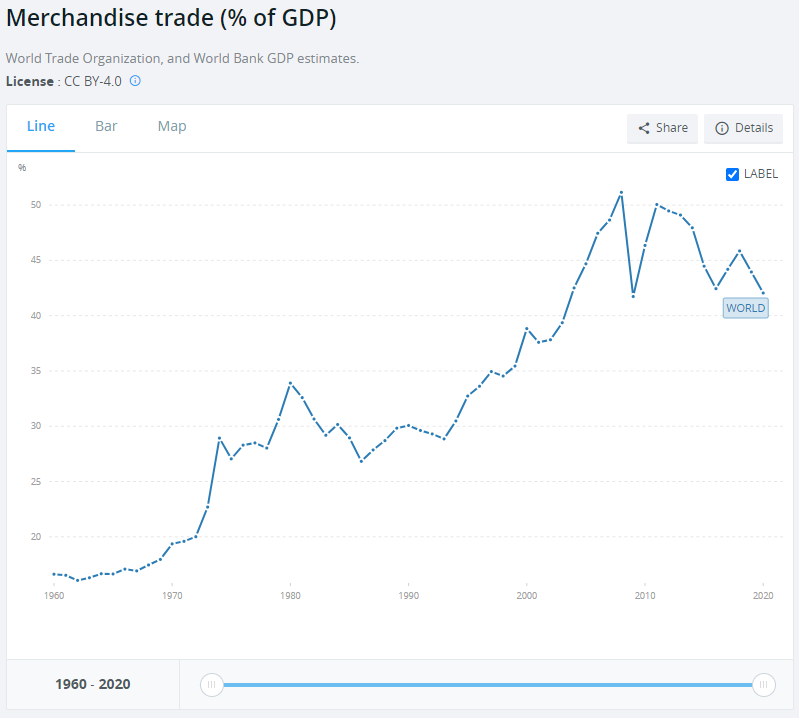

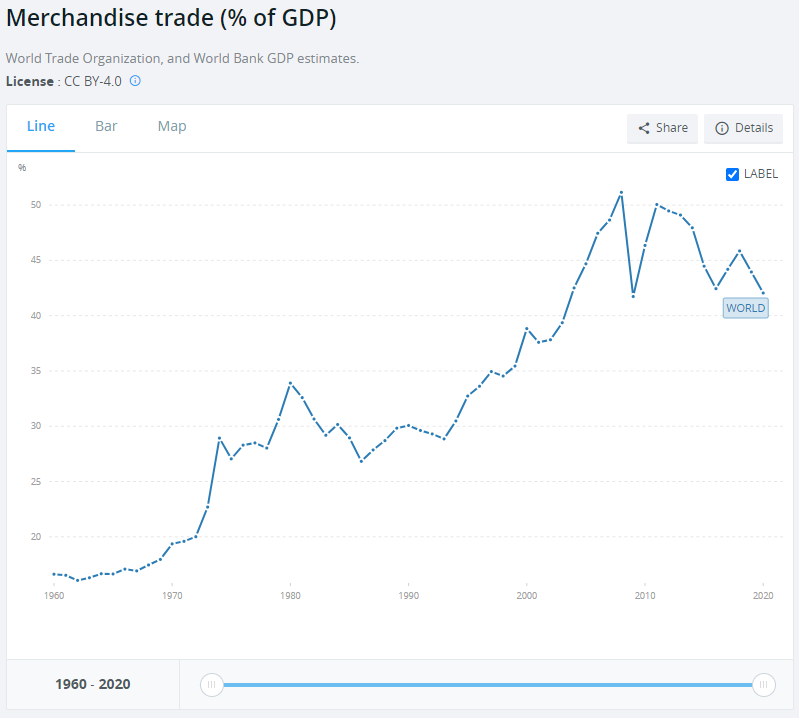

Perhaps the most important thing that many “deglobalization” arguments get wrong is that “globalization” is about far more than just trade in goods. Granted, some focus on goods is understandable, especially given recent supply chain travails; the centrality of goods, tariffs (which apply to goods), and containerized shipping to the typical story of globalization (one I also tell!); and the clear slowdown in global goods trade as a percentage of global GDP since the Great Recession:

Given that goods trade takes up a big chunk of total global trade–which includes goods and services, the data also show that the latter’s GDP share also has declined—though not as much—from its 2008 peak.

However, these topline numbers miss several important things that confound the “deglobalization” story. Most obviously, goods trade as a share of global economic output was down in 2020 from its 2008 peak of 51.2 percent yet was still historically high (42.0 percent)—well above levels seen during the “hyperglobalization” heyday of the 1990s and right around where it was in 2016 (42.4 percent). So we’ve been seeing less “deglobalization” than “slowbalization”—a great pun and more accurate description of recent trends.

More importantly, however, is the fact that slowing trade in goods is a pretty lousy indicator of what’s going on in the global economy. For starters, there’s little reason to think that goods trade should have continued previous decades’ pace: Given practical constraints (e.g., on cost-savings, shipping capacity/speed, or product size), consumer tastes (e.g., demanding certain customized things quickly) and technological developments (e.g., industrial robots), not every manufacturing supply chain can or should become hyper-globalized. Things were bound to slow down eventually.

Furthermore, some of the flattening out likely reflects the fact that—as I explained in a 2020 paper—countries increasingly produce and consume services (and move away from goods) as they develop:

Put simply, as world manufacturing output and agriculture output decline as a share of global economic output over time (because nations are developing and thus shifting a greater share of their economic activity to services), it makes sense that goods trade as a share of global economic output stops increasing at the breakneck pace it exhibited in earlier periods—even as it increases in nominal terms. Many services (e.g., construction, maintenance/repair, or hospitality) are also non-tradable, and there remain many regulatory barriers, such as licensing, to tradable services, so it also makes sense that services trade wouldn’t totally make up the GDP share gap.

But is this “deglobalization”? Not really.

Furthermore, there is plenty of evidence that the world hasn’t given up on global goods trade—even during the pandemic. In the supposedly retrenching U.S., for example, we see that inflation-adjusted merchandise trade (imports plus exports) reached record levels in 2021—a whopping $4.7 trillion in total goods and $4.1 trillion in non-petroleum goods:

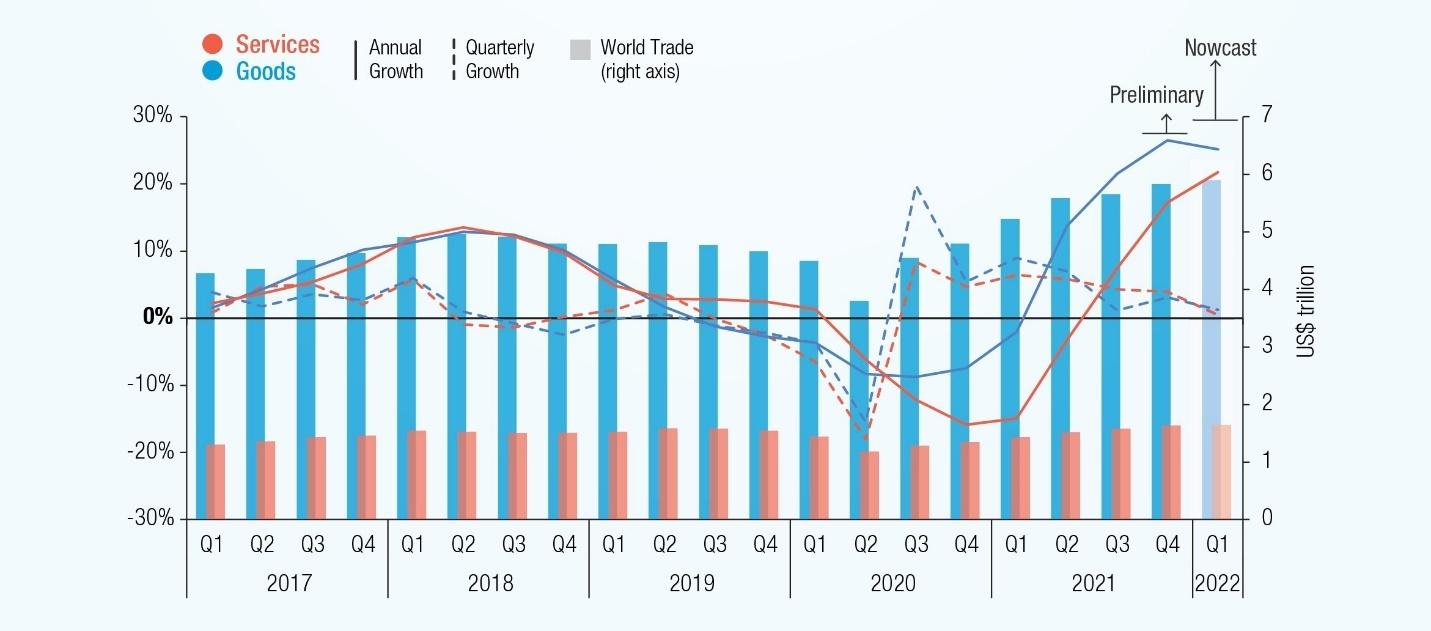

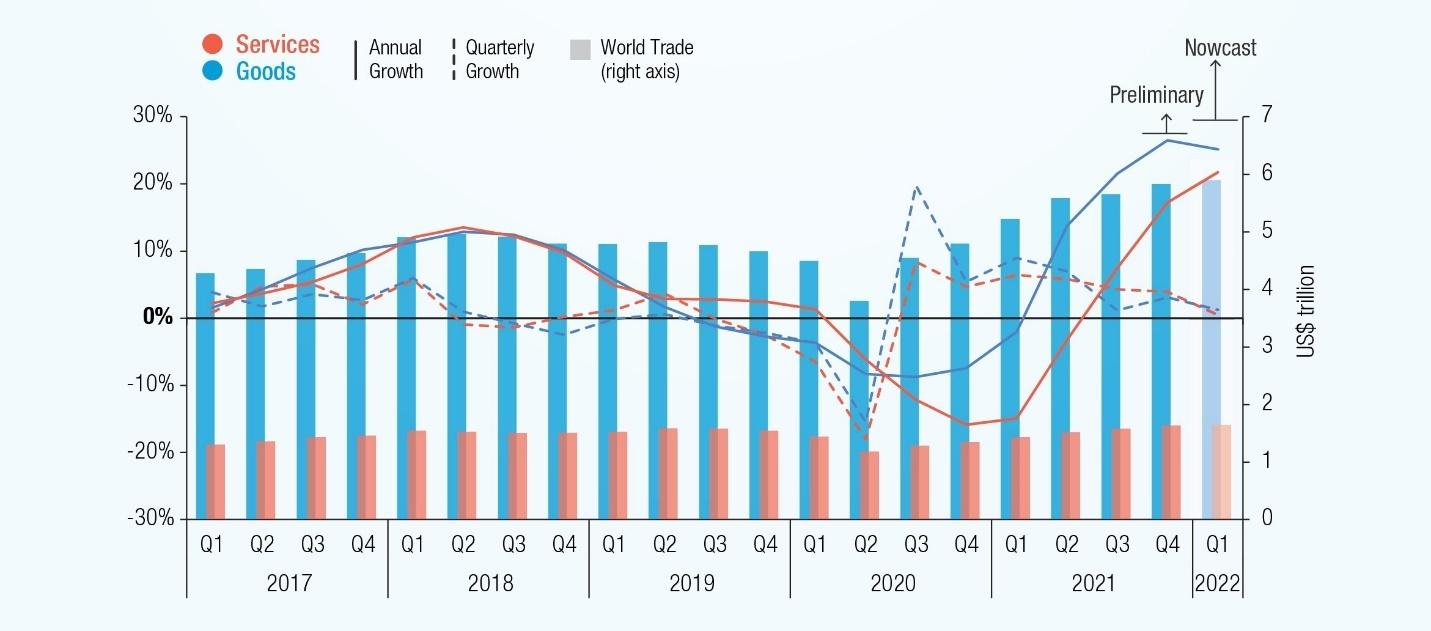

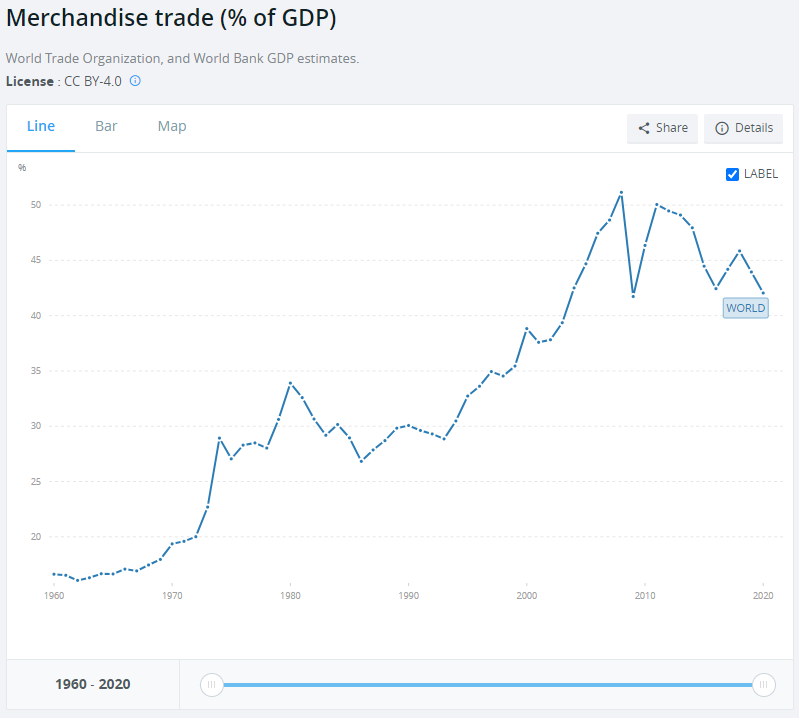

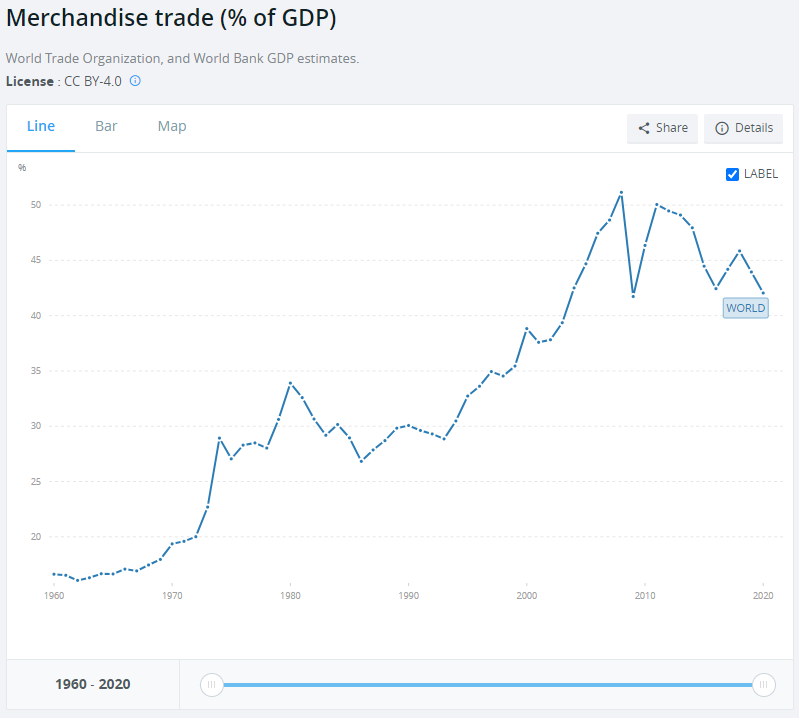

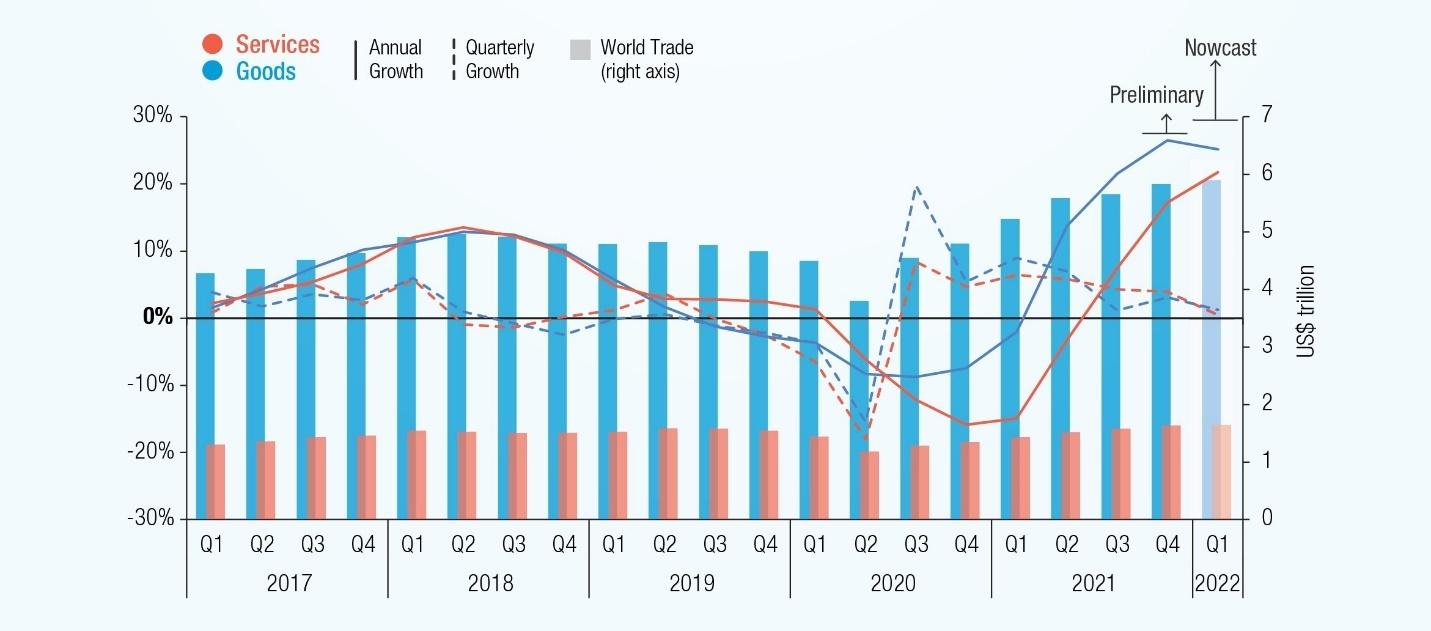

According to the U.N. Conference on Trade and Development, moreover, global trade hit a record high (in nominal terms) last year at $28.5 trillion, driven by trade in goods (which hit a record in the fourth quarter):

The latest data from the WTO, moreover, show that global trade in “intermediate goods”—a sign of companies’ use of global value chains—is well above 2019 levels in all regions:

A big driver in this increase, by the way, was medical goods and vaccine materials—another testament to the COVID-19 vaccines being, as some guy put it, a “Triumph of Globalization.”

Finally, Bloomberg reported earlier this year that a record number of container ships (20,694) traversed the Suez Canal last year, despite the Ever Given getting stuck there for several days, and that experts predict even higher volumes in 2022. The canal is currently being expanded to handle even more traffic in 2023. The Panama Canal, meanwhile, also saw record traffic last year.

In short, it appears that global goods trade is still increasing—just not as fast as the rest of the global economy.

Some ‘Death of Globalization’!

Anyway, merchandise trade is surely important, and some of globalization’s greatest hits (e.g., the iPhone) involve goods, global supply chains, and governments’ liberalization of tariff and related restrictions. However, as indicated above, goods trade is only one part of the “globalization” story—and the other areas of “globalization” show little signs of serious regression and in some cases are forging ahead, despite the pandemic.

Most obviously, we see that global trade in services was continuing to increase before the pandemic, which cratered all trade, even as goods trade (again, as a share of global GDP) had been sagging for years:

Because growth in services trade has outpaced growth in goods trade for going on two decades now, commercial services’ share of total exports has risen from 21.31 percent in 2005 to 24.82 percent in 2019. This is particularly important for trade in computer services, R&D services, and health services, which have seen average annual growth in the double digits:

The pandemic, of course, crippled trade in many services that are dependent on travel (business and leisure), but some activities are seeing an uptick once again—despite the aforementioned government barriers. According to the WTO, for example, “other commercial services”—financial services, business services, and charges for use of intellectual property—rose by 6 percent year-on-year in Q1 2021. Contrary to most transport and travel services, these services avoided large declines in 2020 due to “the widespread adoption of technologies allowing remote work.”

And this gets to probably the hottest area of “globalization” these days: digital trade, which includes the cross-border delivery and consumption of both “information and communication technology” products, such as software, and “traditional” services enabled by those same technologies, such as legal advice, R&D, or online education. Digital trade has been increasing for years now as technology (high-speed internet, mobile phones, etc.) has proliferated, but the pandemic was its rocket fuel: From 2019 and 2020, for example, the share of digitally delivered services exports delivered worldwide increased from around 52 percent to 64 percent, and, while total services exports declined by 20 percent in 2020, digital services declined by only 1.8 percent—in the middle of a global pandemic.

As noted, a lot of this digital trade is traditional services like law or accounting, but an increasing share is novel—what Middlebury’s Gary Winslett calls “Peloton Globalization”:

Not long ago, if a person somewhere in the United States wanted to take a spin class, they did so at a local gym or spin studio. That same person may continue to do so now, or they may get on an exercise bicycle at home, use the Peloton app, and be led through that class by instructor Ben Alldis coaching them from the Peloton studio in London. What was not so long ago a hyper-localized exchange of a service now takes place across international lines and is greatly facilitated by digitalization.

And it has serious implications for how we think about work, life, and “globalization”:

[T]wo trends, international trade in services facilitated by greater digitalization and a shift toward more people working from home, are linked. Once a person is doing their professional work at home and delivering it digitally to whoever pays them, it doesn’t really matter whether that payer is domestic or international and so any dynamic that promotes work from home at least implicitly promotes the digital trade in services. … This is a newly emerging form of globalization that looks very different from ships carrying stacks of cargo containers but it is nonetheless a very real form of globalization. As the 2019 World Trade Report notes, “Globalization is not slowing or stalling. Rather, it is evolving, driven by trade in human skills, knowledge, and ingenuity.” (emphasis mine)

Plenty of data (pun!) on digital trade flows confirm this trend—before and especially after the pandemic hit in 2020. According to a September 2021 UNCTAD paper, for example, global data flows have already increased substantially since 2020—one study found, for example, that domestic and international Internet Protocol (IP) traffic in 2022 “will exceed all Internet traffic up to 2016,” and “[m]onthly global data traffic is expected to surge from 230 exabytes in 2020 to 780 exabytes by 2026.”

Measuring cross-border data flows is difficult, but the most commonly used measure—total used capacity of international Internet bandwidth—has also seen remarkable increases in recent years, with 30 percent increases in both 2020 (719 Tbit/s) and 2021 (932 Tbit/s):

According to UNCTAD, cross-border data traffic is geographically concentrated along two main routes—between North America and Europe, and between North America and Asia—and, again, it’s forecast to grow dramatically:

Current estimates of worldwide digital trade are likely understated—and by significant amounts—because traditional trade statistics have a hard time capturing the origins, volume, and value of cross-border digital transactions. As Bloomberg discussed back in 2019:

If we don’t always fully appreciate the scale of what’s going on, it’s because much of digital trade is not being captured in official statistics, says Susan Lund of the McKinsey Global Institute, the consultant’s in-house think tank. In a report, Lund and her co-authors documented an explosion in global data flows that they argued generated $2.8 trillion in economic output in 2014 alone and was doing more to benefit the world economy than the stalling international trade in physical goods.

In some cases, the World Trade Organization pointed out in a report last year, the rapid propagation of digital technologies has contributed to a false picture of globalization in retreat as shipping containers filled with hardcovers and DVDs are replaced by e-book downloads and streaming music.

While Fortnite is notionally free to play, its maker booked billions of dollars in revenue last year from purchases of limited-edition “skins” and “battle packs” that allow players to customize their avatars. These types of transactions, however, are often not logged properly in economic data. If a player in China or Germany buys an outfit or weapon designed in North Carolina, he is effectively importing a digital good from the U.S.—and helping to support a high-paying job in America.

There are less esoteric examples. Lund, for instance, cites the work of Hal Varian, Google’s chief economist: If the value of the Apple or Android operating systems loaded onto smartphones produced in China and other Asian hubs were counted as an American export to those countries, Varian argues, the U.S.’s $500 billion annual goods and services deficit would be reduced by $120 billion overnight.

Other hidden digital trade activities include “free” or dirt cheap apps, “gig” consulting (especially when arranged by third party platforms like Upwork or conducted via “free” videoconferencing and payment apps), the sharing economy (e.g., Airbnb), and streaming media—much of it generating additional economic activity that we’re also probably missing.

And don’t even get me started on crypto.

Given the remarkable increase in international bandwidth and cross-border data flows in recent years, that estimated $2.8 trillion in 2014 digital trade activity would surely be dwarfed by 2021’s total, which would itself be dwarfed in another few years. For perspective, total merchandise trade was around $17 trillion in 2020; assuming (wrongly!) that digital trade activity experienced the same, six-fold increase that international bandwidth saw between 2015 and 2021, then the value of total digital trade would today be approaching the value of total goods trade!

This is rough, back-of-napkin stuff, but one thing is clear: the charts used to argue “deglobalization” today probably underestimate actual cross-border trade and economic activity—and actual “globalization”—substantially.

Beyond the metrics, the implications of the “new globalization” are, as Winslett notes, potentially incredible for rural communities, health care (telemedicine), small businesses (easy access to foreign customers or suppliers), manufacturing (3-D printing), and especially entertainment:

It’s a very exciting time.

Other aspects of globalization also show little reason for alarm. For example:

-

The estimated number of international migrants has increased from 153 million in 1990 (2.9 percent of the world’s population) to 281 million in 2020 (3.6 percent).

-

Even in the face of the Great Recession and then the pandemic, global capital flows have continued flowing. The Economist reports, for example, that “[i]n 2020 the stock of cross-border financial assets reached $130trn, an increase of almost 60% since 2007”; at 153% of world GDP, these flows have eclipsed 2008’s peak. Preliminary UNCTAD data, meanwhile, show a 77 percent increase in global FDI in 2021 to $1.65 trillion from $929 billion in 2020, surpassing pre-pandemic levels. (The United States, by the way, once again leads the way.)

Finally, there’s the “cultural globalization”—food, media, fashion, etc.—which continues apace. Today, for example:

-

“Ethnic” cuisines are so commonplace that American grocers are struggling to stuff them all in the “ethnic” aisle (buyers and sellers kinda prefer them there!), while “H Mart, a Korean American supermarket chain, has become one of the fastest-growing retailers by specializing in foods from around the world.” And while big cities remain out front of America’s latest global food craze, small towns across the country are now home to a wide variety of “foreign” restaurants and foods. (According to a 2015 survey, 80 percent of Americans “eat at least one ethnic cuisine each month,” and two thirds “eat a wider variety of cuisines than they did five years ago [2010].” These numbers are surely higher today.) The most popular fast-food restaurant in China, meanwhile, has long been KFC.

-

Last year, Puerto Rican rapper Bad Bunny, who rose to fame writing and singing in Spanish, was the most streamed artist on Spotify for the second year in a row; “K-Pop” boy-band BTS was also in the platform’s top five and is regularly featured in U.S. commercials. (I have no idea who any of these people are—I asked a Zoomer research assistant for help.)

-

High fashion has always been global, but “fast fashion” today is too, featuring names like H&M (Sweden), Zara (Spain), Uniqlo (Japan), and Shein (China).

Most telling of all, however, may be TV and movies—especially at streaming giant Netflix. Of the American company’s 200-plus million subscribers, for example, fewer than half (around 73 million) are in the United States and Canada.

Netflix also streams and produces tons of “foreign” (non-U.S.) content. Indeed, several of the most popular Netflix shows of all-time are foreign-language shows:

Bloomberg adds that, “People actually spend more time watching foreign-language TV in the [Netflix] top 10 than shows in English.”

Even American viewers, moreover, are increasingly binging on foreign-language content. In 2020, for example, U.S. viewership of foreign-language titles grew by more than 50%, and, of course Squid Game—a Korean show dubbed into English!—dominated 2021.

So the next time you’re sitting on your IKEA couch, wearing a Uniqlo T-shirt, eating grocery store sushi, and streaming either a Bad Bunny track or the Squid Game Season 2 trailer on your iPhone, please take a moment to lament the Death of Globalization.

(Which you probably first read about in The Economist a few years ago.)

Most of the above is backward-looking, and Russia/Ukraine is of course happening right now. So next week I’ll look at two other big misunderstandings about “globalization”—the rules (trade agreements) governing it and whether recent events really mean we’ll be “de-globalizing” in the near future. Stay tuned.

Chart of the Week

The Links

On (mis)understanding Smith and Ricardo